February 3, 2026

10 minutes

Wondering how much your VA disability check will be in 2025?

This guide breaks it down clearly - estimated monthly rates, why they’re rising, and how to unlock even more value from your VA benefits.

- Estimate your monthly pay based on your rating and dependents

- Understand the 3.2% COLA boost and how it impacts your income

- Explore extra benefits like housing grants and VA loans - worth thousands

- Let’s dive into how 2025 benefits stack up - and what they unlock.

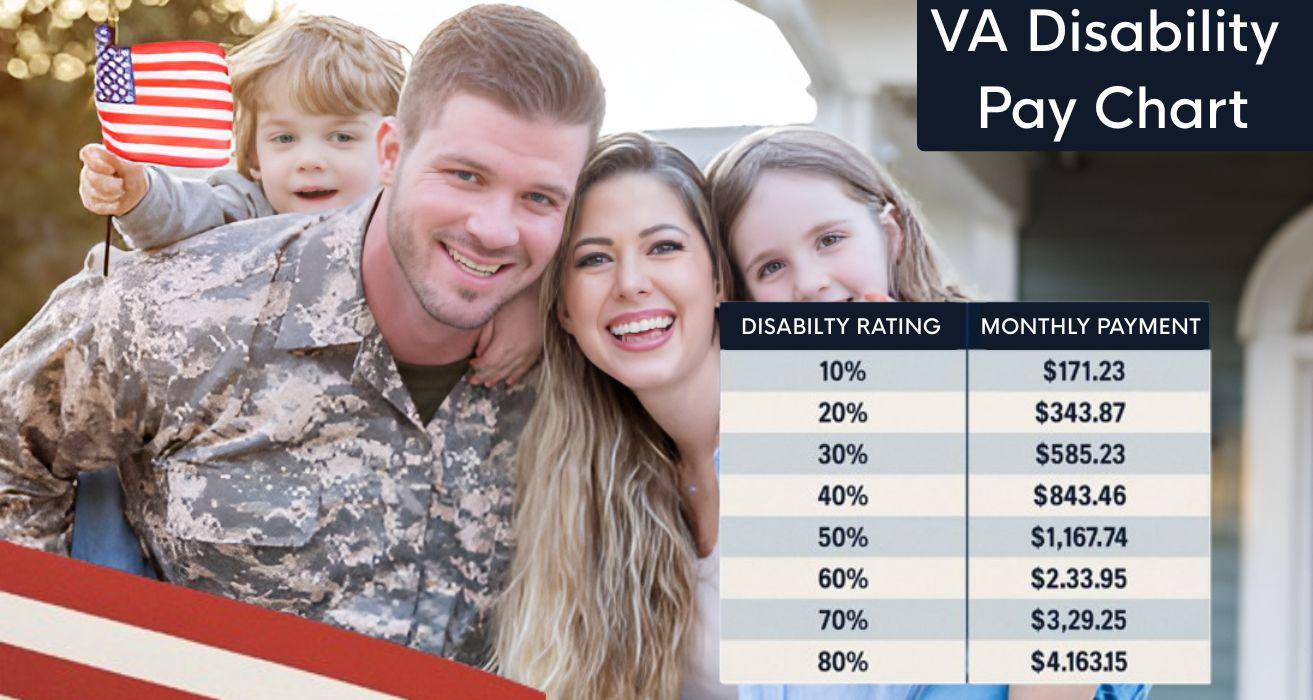

2025 VA Disability Pay Chart (3.2% COLA Estimate)

Bottom line: You’ll likely earn $171–$3,993/month in 2025 - depending on your rating and family status.

| Disability Rating | Single Veteran | +Spouse | +1 Child |

|---|---|---|---|

| 10% | $171 | N/A | N/A |

| 20% | $338 | N/A | N/A |

| 30% | $524 | $587 | $610 |

| 50% | $1,075 | $1,167 | $1,205 |

| 70% | $1,740 | $1,845 | $1,889 |

| 90% | $2,168 | $2,287 | $2,336 |

| 100% | $3,737 | $3,926 | $3,993 |

Estimates based on projected COLA. Final rates drop in October 2024.

How the VA Calculates Your Disability Pay

The VA uses a structured process to determine your monthly compensation:

1. Disability Rating (0% - 100%)

Your rating reflects how much your condition impacts your ability to function and work. It’s assigned in 10% increments.

Get Pre-Approved and Save Up to 1.5% at Closing with reAlpha

Save up to 1.5% at closing when you combine real estate and mortgage services with reAlpha.

2. Combined Ratings

If you have multiple service-connected conditions, the VA applies a formula - not simple addition-to calculate your total rating.

Example: A 60% rating combined with a new 30% disability does not equal 90%.

3. Dependent Status

Veterans with spouses, children, or dependent parents receive higher monthly payments. Be sure to update your dependency status on VA.gov to ensure accuracy.

2025 VA Disability Pay Increase

VA disability compensation is tied to the Social Security Administration's annual Cost-of-Living Adjustment (COLA). This adjustment helps protect your buying power as inflation changes.

Projected COLA for 2025: 3.2%

Recent COLA History:

| Year | COLA % |

|---|---|

| 2025 (est.) | 3.2% |

| 2024 | 3.2% |

| 2023 | 8.7% |

| 2022 | 5.9% |

Final COLA rates are typically confirmed in October, and the VA implements them for payments beginning December 1 each year.

How to Increase Your VA Disability Rating

If your condition has worsened or you believe your current rating doesn’t reflect your limitations, you have options:

1. File for a Rating Increase

Submit VA Form 21-526EZ via VA.gov and provide current medical records or provider statements showing your condition has declined.

2. Appeal a Decision

Choose from one of three appeal paths:

- Higher-Level Review

- Supplemental Claim

- Board Appeal

3. Common Conditions for Rating Increases

- PTSD, anxiety, and other mental health disorders

- Chronic back pain, arthritis, or joint damage

- Migraines, sleep apnea, or respiratory issues

- Cardiovascular or neurological decline

A strong medical opinion (e.g., a Nexus Letter) can strengthen your case for an increased rating.

See all your VA benefits.

VA Loans: Best-Kept Secret for Disabled Veterans

With your disability rating, you could:

- Skip the down payment

- Pay no PMI

- Lock in low interest

- Waive the funding fee (for most)

- Enjoy assumable mortgage perks

Explore VA loan options.

Is a VA Loan Worth It for 100% Disabled Veterans?

Absolutely. You'll skip the funding fee, avoid PMI, and unlock lower rates. Over time, that can save you $10,000 or more.

Tap into VA loan benefits.

VA Disability Benefits Beyond Monthly Compensation

Your VA disability rating may also unlock access to additional benefits, including:

Housing Grants

Specially Adapted Housing (SAH) and Special Home Adaptation (SHA) grants help modify your home for service-connected mobility impairments.

Healthcare

Veterans with service-connected disabilities may qualify for free or low-cost care through the VA healthcare system, including mental health, dental, and specialty services.

Education & Employment

Depending on your rating, you may qualify for benefits like:

- Post-9/11 GI Bill

- Veteran Readiness and Employment (VR&E)

- Tuition assistance and job training

Property Tax Relief

Many states offer full or partial property tax exemptions for disabled veterans. These benefits vary, so check with your local tax authority.

VA Loans for Disabled Veterans

VA home loans offer powerful advantages - especially for those with a disability rating.

- No down payment required

- No PMI (private mortgage insurance)

- Competitive interest rates

- Funding fee waived for most disabled veterans

- Assumable loans, which allow another qualified borrower to take over your mortgage

If you’re considering buying, refinancing, or accessing home equity, explore options like the VA cash-out refinance or Interest Rate Reduction Refinance Loan (IRRRL).

Make the Most of Your VA Benefits - And Save Thousands at Closing

Make the Most of Your VA Benefits - And Save Thousands at Closing

You earned your VA benefits. Now it’s time to turn them into real savings on your dream home. With reAlpha Mortgage, you can skip the PMI, waive the funding fee, and access exclusive veteran support - plus unlock up to 1.5% of your buyer agent’s commission back.

Veterans Can Save Up to 1.5% at Closing with reAlpha

Save up to 1.5% on your purchase price by using reAlpha Realty and Mortgage together.

Here’s how it works:

- Get 0.5% back by using a reAlpha agent

- Add reAlpha Mortgage to reach 1% rebate

- Bundle with reAlpha Title to unlock the full 1.5%

That’s real cash you can use toward closing costs, inspections, or move-in upgrades. Ready to buy smarter?

Explore your savings with reAlpha Mortgage

Related Guides for Veterans and Homebuyers

- Safest cities to live in North Carolina

- Affordable places to live in Arizona

- Affordable cities to live in Colorado

- Safest places to live in Georgia

- Affordable places to live in Washington

- What are the safest places to live in Florida

- Safest places to live in Illinois

- Safest places to live in Virginia

- Safest places to live in Ohio

- Top 10 affordable places to live in Florida in 2024

- Most affordable places to live in Michigan

- Safest places to live in Arkansas

- Cost to build a house in New Jersey

- Property tax New Jersey

- How much does it cost to build a house in Florida

- When is the best time to buy a house in Florida

- Top affordable places to live in NJ close to NYC for 2024

- Cost to build a house in Florida

- Safest places to live in Pennsylvania

- Best places to buy a beach house in Florida

Make the Most of Your VA Benefits - And Save Thousands at Closing

You’ll likely receive a 3.2% boost in your monthly tax-free compensation, depending on your current rating and dependency status.

When will I receive my updated benefits?

VA disability checks for 2025 start hitting accounts on the first business day of January. Payments will continue monthly thereafter.

Can I work while getting VA disability?

Yes, you can work - unless you're receiving Total Disability based on Individual Unemployability (TDIU), which has income restrictions.

How do I check my VA disability rating?

Log in to VA.gov or call 1-800-827-1000 to view your current rating and benefits breakdown.

How do I apply for a rating increase?

Submit VA Form 21-526EZ through VA.gov with updated medical records and a nexus letter from your provider.

For expert loan guidance and to maximize your homebuying benefits, reAlpha Mortgage can walk you through your next move.

Get the latest market trends, homebuying tips, and insider updates—straight to your inbox. No fluff, just the good stuff.

Article by

Rocky Billore is a mortgage industry leader and Chief Sales Officer with over two decades of experience across residential and commercial lending. Since entering the industry in 2004, he has been directly involved in funding more than $1.4 billion in loans. A recognized expert in VA and government lending, Rocky combines deep program knowledge with a data driven, relationship-first leadership style. His work focuses on building scalable sales organizations, developing high performing teams, and aligning technology with real world lending outcomes to improve the homeownership experience.